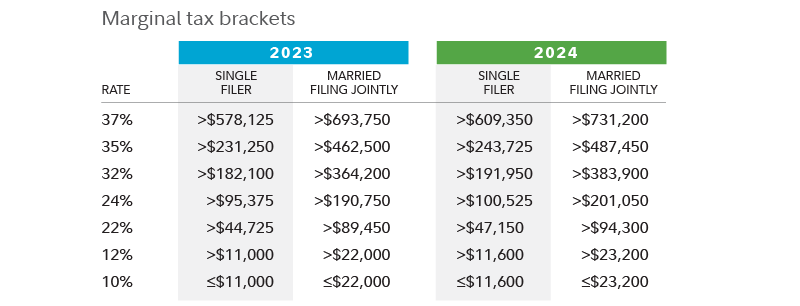

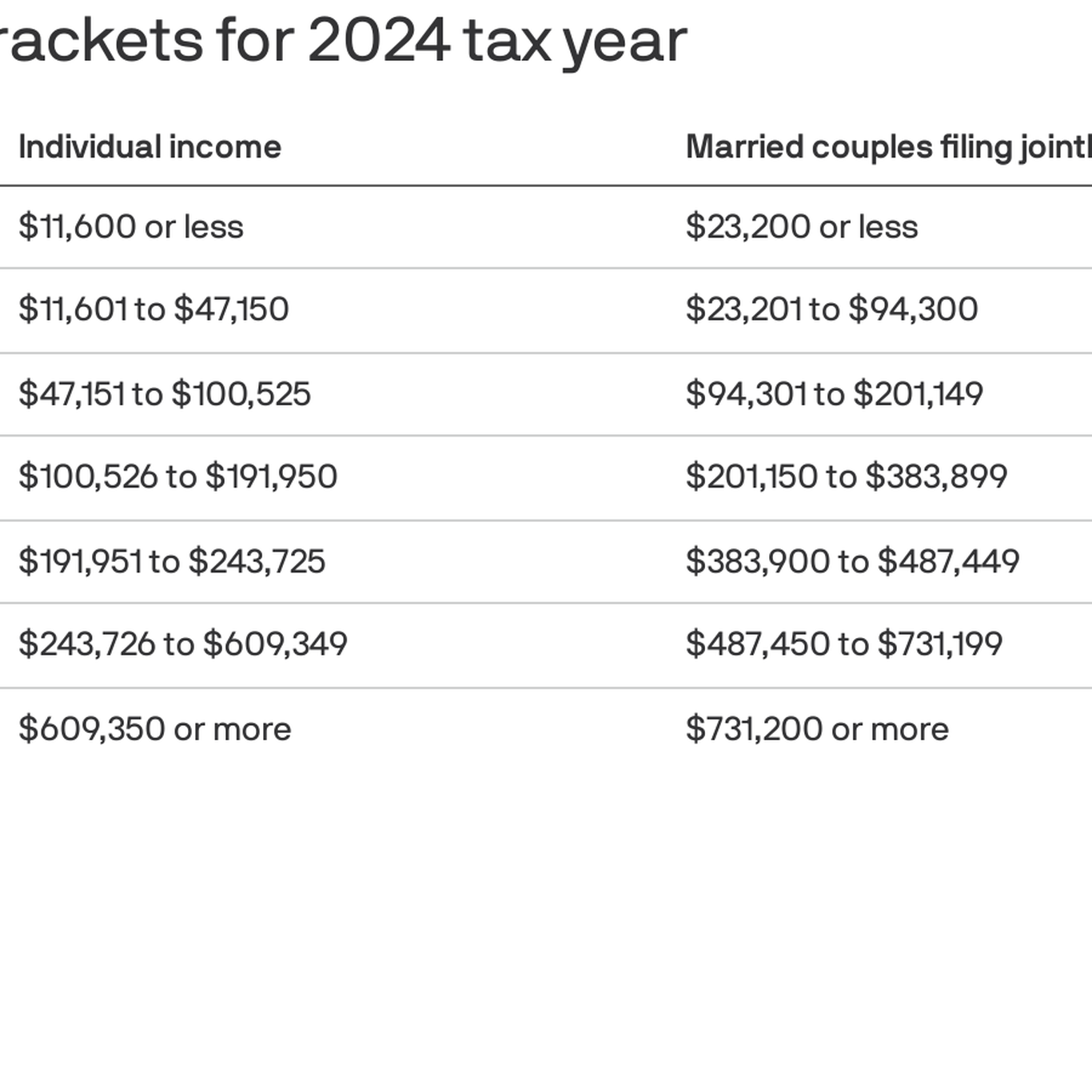

Tax Brackets 2024 – There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . New inflation-adjusted tax brackets go into effect for the 2024 tax season, says the Wall Street Journal’s Ashlea Ebeling. .

Tax Brackets 2024

Source : www.cnbc.com

2024 Tax Brackets | Taxed Right

Source : taxedright.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Americans will take home more income as IRS changes tax brackets

Source : www.actionnewsjax.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Tax Brackets 2024 IRS: Here are the new income tax brackets for 2024: The IRS reviews all income tax brackets annually, making adjustments as necessary to balance for inflation. For the 2024 tax year, tax rates range from 10% at the low end to a top rate of 37%. These . Investment income is treated differently from wages by the tax code. There is a separate set of tax brackets and rates for long-term capital gains and qualified dividends. SEC Approves Bitcoin ETFs .

:quality(70)/d1hfln2sfez66z.cloudfront.net/01-04-2024/t_903e8050a8c34db8af3dc5d275738e8d_name_file_960x540_1200_v3_1_.jpg)